Another way to allow continuing operations is to calculate the terminal value. A terminal value assumes that the cash flow in the final year of projection will continue at the same level into the future. Understanding the capital budgeting process is simplified by flashcards offered by Quizlet. This analysis provides inputs for justifying the investment to relevant stakeholders.

Throughput Analysis

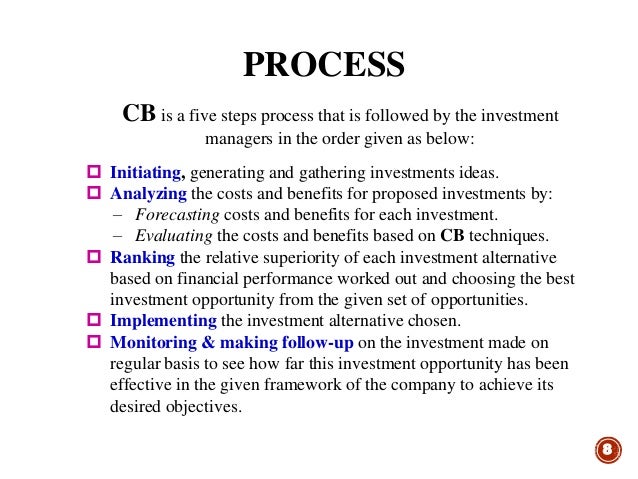

In practice, projects are mostly evaluated on the basis of multiple techniques before they are finally accepted for investment. The NPV, PI and IRR work well and are often relied upon because they are all based on time value of money. When any business is considering a new project or investment, there must be a lot of forethought, analysis, and preparation. Key stakeholders will look at how much money they expect the investment to bring in and compare it to how much it will cost.

Integration with accounting software

- Publicly traded companies might use a combination of debt—such as bonds or a bank credit facility—and equity, by issuing more shares of stock.

- This sophisticated approach considers the value of flexibility in project decisions, including options to expand, delay, or abandon investments.

- These are investments of significant value, such as the purchase of a new facility, fixed assets or real estate.

- Therefore, management will heavily focus on recovering their initial investment in order to undertake subsequent projects.

- Luckily, this problem can easily be amended by implementing a discounted payback period model.

- It can also reject projects with an ARR less than the expected rate of return.

These funds can be swept to cover operational expenses, and management may have a target of what capital budget endeavors must contribute back to operations. Companies are often in a position where capital is limited and decisions are mutually exclusive. Management usually must make decisions on where to allocate resources, capital, and labor hours.

Difficulty in estimating cash flows accurately

This includes studying consumer behavior patterns, technological advancements, regulatory changes, and economic indicators that might influence the success of potential investment projects. Reporting of results should be done on a monthly or quarterly basis to make sure revenues and expenses stay in line with your projections. This will help you identify any deviations from the expected results and take timely corrective actions to get back on course. Internal Rate of Return refers to the discount rate that makes the present value of expected after-tax cash inflows equal to the initial cost of the project. The payback period refers to the number of years it takes to recover the initial cost of an investment.

Internal Rate of Return (IRR)

Create detailed documentation of assumptions and methodologies used in projections to ensure consistency and enable periodic reviews of estimation accuracy. Organizations struggle with developing effective monitoring systems, what is average payment period and how to calculate it establishing relevant performance metrics, and implementing timely corrective actions when deviations occur. Maintaining consistent monitoring across different project stages adds another layer of complexity.

Gathering information and making cash flow estimates

Approval of capital projects in principle does not provide authority to proceed. A lump sum is often included in the capital budget for projects that are not large enough to warrant individual consideration. Total returns can help compare the performance of investments that pay different dividend yields. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

The implementation plan should also include a timeline with key project milestones, including an end date if applicable. Capital budgeting is a multi-step process businesses use to determine how worthwhile a project or investment will be. A company might use capital budgeting to figure out if it should expand its warehouse facilities, invest in new equipment, or spend money on specialized employee training. Although the least accurate of capital budgeting methods, payback analysis gives a quick look at the value of a project. In essence, payback analysis figures out how long it takes to recapture the cost of an investment and whether or not that timeline makes sense for the project. This is a method used to quickly recoup one’s capital investment by comparing the initial cash outflow to the subsequent cast inflows to figure out the point in time at which the project will have paid for itself.

Capital budgeting is concerned with identifying the capital investment requirements of the business (e.g., acquisition of machinery or buildings). Capital budgeting also allows those same decision makers to compare two or more different projects to find the project that will make the most sense for the business and shareholders. They’re often looking for not just a high amount of profit from the project but a lot of value, which might include longevity or a way to invest in the business to give it more ways to expand in the future.

Leave a Reply